Since the fiscal year of 2019, companies or juristic person belonging to the same group (the “Related Companies or Juristic Partnerships”) are obliged to comply with the transfer pricing regulations set out under the new section 71 bis and section 71 ter of the Thai Revenue Code (the “TP Regulations”).

The introduction of the TP Regulations is an essential step towards improving and harmonizing the transfer pricing regulations in Thailand to be consistent with the Organization for Economic Co-operation and Development’s (OECD) standard.

In essence, the TP Regulations require the disclosure of related party transactions that occurred during the relevant reporting period and empower the assessment official to adjust taxable income and expenses of the Related Companies or Juristic Partnerships that are engaged in Commercial or Financial Terms designed to facilitate profit shifting (“Profit Shifting Transaction”).

Following the TP Regulations in 2018, several subordinate regulations were scheduled to be announced in order to provide detailed guidance on its implementation.

On 16 November 2020, the Ministerial Regulation No. 369 (the “MR No. 369”) and the Ministerial Regulation No. 370 (the “MR No. 370”) were announced.

A detailed summary of the Ministerial Regulations are listed below:

1. Ministerial Regulations No. 369

Under section 71 bis, Commercial or Financial Terms agreed between the Related Companies or Juristic Partnerships, which are believed to have characteristics of profit shifting, may lead to the adjustment of taxable income or expenses. According to MR No. 369, two issues are determined; (i) the characteristic of Profit Shifting Transaction and (ii) the benchmarking transaction for the adjustment of income and expenses.

(i) The characteristics of Profit Shifting Transaction

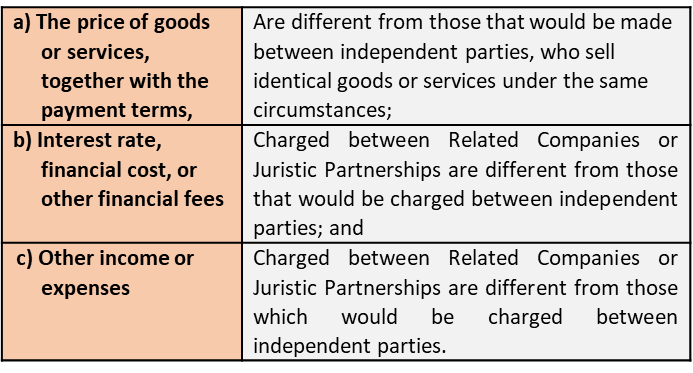

Commercial or Financial Terms having the following characteristics will be regarded as a Profit Shifting Transaction:

(1) having commercial or financial terms;

(2) the Commercial or Financial Terms are different from those that would be made between independent parties; and

(3) the Commercial or Financial Terms will result in a profit shifting between Related Companies or Juristic Partnerships through one of the following mechanism:

The “Commercial or Financial Terms” in this regard means “terms, agreements or any contracts relating to the sale of goods, provision of services, marketing, advertising, or any other activities relating to commercial, provision of loans, provision of financial support or

collaboration, or other financial activities, regardless of whether the arrangement has been made in writing.”

Hence, it is safe to say that the definition of “Commercial or Financial Terms” encompasses a wide spectrum of activities, and any forms of the commercial arrangement entered between Related Companies or Juristic Partnerships could be subject to transfer pricing scrutiny by the Thai Revenue Department. Also, it is assumed that the assessment official has information on transactions of independent parties to determine the Profit Shifting Transaction.

(ii) The benchmarking transaction for the adjustment of income and expenses.

As a consequence due to the Profit shifting Transaction, the assessment official is authorized to adjust the taxable income and expenses of those companies based on an arm’s length price. In practice, the assessment official would consider several relevant factors, including information to establish a benchmark (the “Benchmarking Transaction”) in determining an appropriate arm length’s price. Thus, the MR No. 369 outlined a rule that the assessment official shall adhere to in the process of identifying the Benchmarking Transaction prescribed as follows;

(1) If the Related Companies or Juristic Partnerships enter into an identical transaction with other independent parties (the “Internal Comparable”), the information relating to income or expenses charged under the transaction shall be applicable for the measurement of the arm’s length price.

If the Related Companies or Juristic Partnerships did not enter into an identical transaction with other independent parties, the information relating to income or expenses charged under an identical transaction, which has taken place either onshore or offshore, between other companies or juristic partnerships (the “External Comparable”) shall be applicable for the measurement of the arm’s length price.

Thus, in determining the Benchmarking Transaction, the MR No. 369 interprets that Internal Comparable shall apply before the External Comparable. The External Comparable will apply only when the Internal Comparable is not available.

More details on the Profit Shifting Transaction and the adjustment of income and expenses will be prescribed by the subsequent notification from the Director-General of the Thai Revenue Department.

2. Ministerial Regulations No. 370

The MR No. 370 reaffirms that the obligation to file TP Disclosure Form, as well as the Local/Master File (if required) under section 71 ter shall not apply to Related Companies or Juristic Partnerships that generate income not exceeding THB 200 million in an accounting period.

According to section 71 bis, there are TP Regulations that have not yet been announced regarding (i) the characteristic of the related juristic person in terms of capital, management, or control, which is considered as a dependent situation; and (ii) the regulations prescribing details of the adjustment of taxable income and expenses.

We will keep you informed once the announcement of these regulations has been made. As those regulations are still unclear, taxpayers should double their efforts to ensure transfer pricing compliance.

For more information, please contact the authors or alternatively, you can reach out to our Tax Practice Group.

About Us

TAX Practice Group

Businesses often need proper tax planning and an efficient structure to sustain and enjoy long-term success. Our main goal is to provide a “one-stop service” where we can seamlessly connect with other practice to provide the most appropriate advice to our clients.

We have extensive experience in tax issues related to M&A, restructuring, transfer pricing and wealth management especially when clients are faced with new business models, IPOs, as well as buying or selling assets to ensure tax mitigation and optimization. We conduct due diligence to determine whether or not tax planning is possible or required. This involves sharing specific tax privileges that our clients may or may not know they qualify for.

Our clients extends to a wide spectrum of segments; corporations, family businesses, and high net worth individual / ultra high net worth individual, who we believe requires attentive services and a responsive team, a value we strive and are known for.

Authors:

Saravut Krailadsiri

Partner

saravut.k@kap.co.th

Pichaya Nimcharoen

Associate

pichaya.n@kap.co.th