Business leaders worldwide have been confronted with severe challenges arising from the COVID-19 pandemic. To mitigate the effects, business leaders have been exercising a high degree of care in monitoring and operating their businesses in order to assess and adapt to the fast-changing developments initiated due to the pandemic. The COVID-19 pandemic has affected all business sectors, and the capital markets sector is no exception.

COVID‐19’s Impact On New And Existing IPOs

Capital market transactions in Thailand, particularly with most initial public offerings (IPOs), have either been postponed or cancelled, even if there are business continuity plans in place. Companies that plan for IPOs but are postponed due to uncertainty in the capital market will be required to, amongst other things; update their financial status, both consolidated and quarterly statements to reflect the true performance of such companies. Other considerations for IPO filings during and post COVID-19 pandemic are further discussed in the next section below.

The COVID-19 pandemic has not only disrupted businesses and markets, but has also led to stock prices plummeting. This in turn has led to a reduction in investors’ demand to invest in most companies’ shares. As a result, in order to stimulate investors’ demand, companies that plan for IPOs have been forced to reduce their share subscription prices, and may even have to accept that their share prices post-IPO could be lower than the IPO price. In the latter case, it may take months or years for the share price to climb back to the expected value. Companies whose filings had recently been approved by the Securities and Exchange Commission of Thailand (the “SEC”) prior to or during the COVID-19 pandemic may be faced with such circumstances, as they are required to launch the IPOs and complete the offerings within 6 months and in any case no later than 12 months from date of the SEC’s approval.

SEC’s Filing in Full Operation

While most companies have placed their plans for IPOs on hold, some companies that have benefited from the COVID-19 pandemic have proceeded as planned. For example, in March 2020, Sri Trang Gloves (Thailand) Public Company Limited, a company operating a rubber processing plant and glove production business, successfully completed its IPO filing and launched its IPO in early July 2020. Accordingly, the filing and approval processes of the SEC remain in full operation without any interruption despite the COVID-19 pandemic. Companies are still able to complete and submit their filings via the SEC’s digital platform, and once submitted, the relevant SEC official(s) is obligated to review and approve the filing within the specified timeline. As of June 2020, there are 14 companies in the process of IPO filings with the SEC.

Considerations For IPO Filings During And Post Covid-19 Pandemic in Thailand

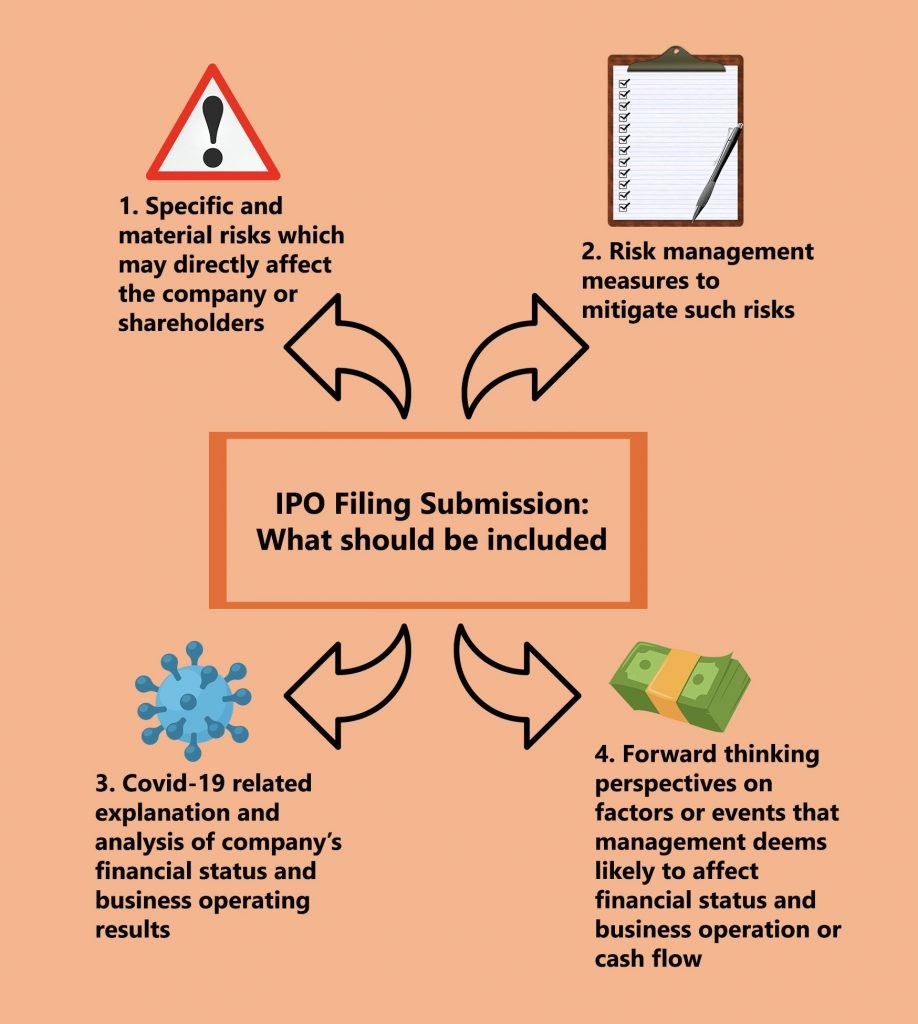

For a company planning to submit a filing or a company whose filing is currently under the review of the relevant official at the SEC, the potential impact of the COVID-19 pandemic must now be included and addressed in the filing, particularly in the risk factors and the management discussion and analysis section (the “MD&A”). For instance, all specific and material risks which may directly affect the company or its shareholders and any other potential risks the COVID-19 pandemic may expose the company to, as well as the risk management measures in place to mitigate such risk, must be disclosed in the filing. Similarly, a COVID-19 related explanation and analysis of the company’s financial status and business operating results, and a forward-thinking perspective on the factors or events that the management deems likely to affect the financial status and business operation or cash flow of the filing company must also be provided in the filing. Failure to disclose such information as required under the Securities and Exchange Act B.E. 2535 (1992) (as amended from time to time) will expose director(s) and executive(s) of such relevant company to a joint liability penalty.

As scientists around the world are working hard to come up with a new reliable vaccine, we believe the capital market will slowly retrieve its certainty and soon, the confidence from players in the market. We are all looking forward to the day things are back to normal.

For further information, please contact our Capital Markets Practice Group at Kudun and Partners.

Our Capital Markets Practice Group

Praised by our clients for providing cutting-edge advice on complex securities and regulatory matters, our capital markets practice continues to represent many companies in their IPO transaction covering various sectors. Our partner, Kom Vachiravarakarn’s professional experience as a senior legal officer with SET has been instrumental in giving our firm the edge when it relates to offering expert securities regulatory advice to clients.

Authors:

Kom Vachiravarakarn

Partner

kom.v@kap.co.th

Thitawan Thanasombatpaisarn

Senior Associate

thitawan.t@kap.co.th

Amonwan Chatchaliwaphong

Associate

amonwan.c@kap.co.th

Apheesada Sajjaphanroj

Associate

apheesada.s@kap.co.th